NIBC’s Commercial Real Estate Portfolio sees steady growth in H1 2024

NIBC has reported continued growth in its Real Estate portfolio for the first half of 2024, underscoring that the bank’s clear strategic focus on financing selected Real Estate asset classes for strong and knowledgeable clients works. NIBC successfully expanded its Real Estate portfolio by 2%, reaching EUR 1,888 million as of June 2024.

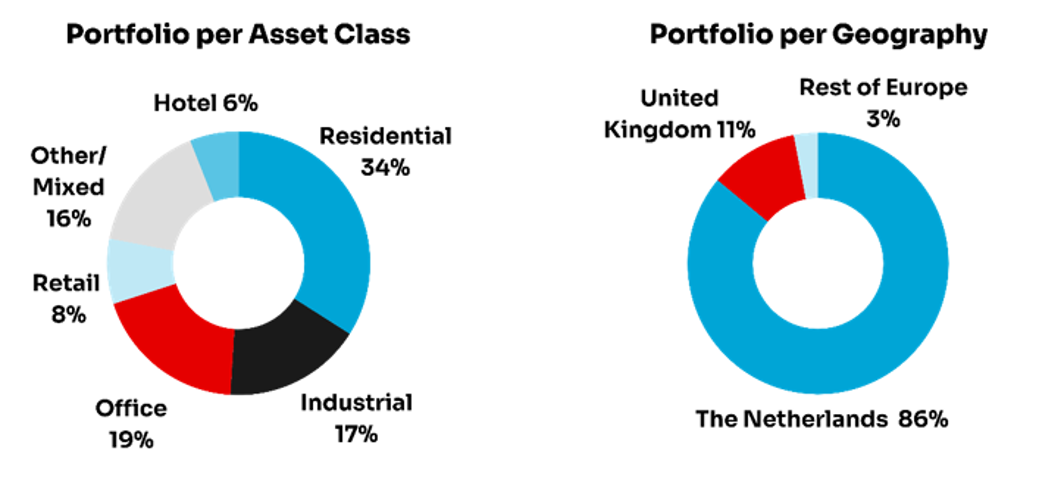

NIBC’s Real Estate team, a cornerstone of the bank’s Asset Based Finance segment, implemented a targeted origination strategy focused on domestic and European residential real estate projects. Also, the bank remains active for selective clients in all other Real Estate asset classes. This approach has enabled the bank to grow its portfolio, supporting the development of sustainable and resilient real estate assets across the region.

Jan Willem van Roggen, Managing Director and Head of NIBC Real Estate, commented on the company’s performance: “We are proud to announce that last month, we surpassed the milestone of EUR 2 billion in exposure, a clear proof of our commitment to supporting our clients and adapting to the ever-evolving market conditions”

During the first six months of 2024, NIBC provided financing to a range of real estate projects, reinforcing its position as a trusted partner for developers and investors in the real estate sector. The bank’s ability to offer flexible solutions has been instrumental in helping clients navigate the complexities of today’s real estate market and pursue their sustainability objectives.

NIBC proactively engages with clients on their sustainability transitions. The bank has been at the forefront of gathering essential data to measure and report on the sustainability of the assets it finances. This capability not only aligns with regulatory requirements but also allows NIBC to support the development of greener and more sustainable real estate projects, which are increasingly in demand by investors and regulators alike.

“Our commitment to sustainability is not just about meeting regulatory requirements; it’s about creating long-term value for our clients and the communities in which they operate,” added van Roggen. “By focusing on sustainable growth and responsible financing, we are helping to build a more resilient and inclusive real estate sector.”

Looking ahead, NIBC remains focused on supporting its real estate clients through tailored financing solutions that align with their long-term strategic goals. The bank’s expertise in real estate financing, combined with its entrepreneurial spirit and reliable internal processes, positions it well to continue driving growth in a challenging market.

We refer to our Interim Report 2024 NIBC Holding N.V. published on our website for full details.