We are a lender in the European living space

Experience since 1945

NIBC is a Dutch bank, owned by Blackstone, with a longstanding track record in tailor made development and construction financing of commercial real estate in the Netherlands and a longstanding track record in Digital Infrastructure financing within Europe.

Financing €/£15m-€/£50m

We focus on financing Living developments, properties and larger portfolios. NIBC provides ticket sizes between €/£15m-€/£50m, typically in club deal settings alongside other lenders.

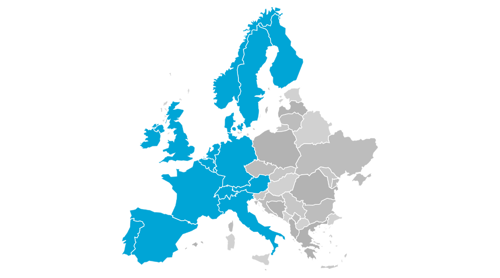

Geography

We focus on key cities across Europe and the UK. These include among others: the United Kingdom, Ireland, Spain, Italy, Portugal, France, Germany, Austria, Switzerland (DACH), Sweden, Denmark, Norway (Nordics) and our home market, the Benelux.

Partnership & Collaboration

Our team offers upfront clarity and is committed to be a transparent financing partner throughout the entire financing process. Driven by our expertise and growth mindset, we are dedicated to providing our clients and financing partners execution certainty.

We focus on lending into high quality, purpose-built Living developments and assets

These residential properties for rent typically include a range of amenities, like a concierge, gym, laundry and working spaces, and are operated by a third party.

Targeting a wide range of tenants, we finance Build to Rent (BTR), Purpose Built Student Accommodation (PBSA), Co-Living / Flex-Living and Senior Living.

Our finance solutions

We specialize in providing residential real estate financing and built to rent financing to lenders arranging and underwriting financing solutions for residential real estate projects across Europe.

-

Development financing for the land acquisition, construction costs and total budget for new Living developments.

We provide financing for developments with €/£ >120m in Gross Development Value.

-

Stabilization financing for Living schemes that are about to or have recently reached practical completion.

We provide financing for standing assets or portfolios of assets valued €/£ >120m and developments with €/£ >120m in Gross Development Value.

-

Investment financing for Living schemes that are about to reach full occupancy.

We provide financing for standing assets or portfolios of assets valued €/£ >120m and developments with €/£ >120m in Gross Development Value.

Contact Ljudmila to explore financing opportunities

Highlighted Residential Real Estate Deals

Client quotes

Our Residential Real Estate Client Cases

Our latest news & blogs

Do you want to stay up to date with our latest news? Subscribe to our quarterly business update and follow us on LinkedIn.

Our other financing options

We understand that every business is unique, and we tailor our approach accordingly.