NIBC’s Infrastructure portfolio demonstrates resilience amidst market competition in H1 2024

NIBC has reported steady growth in its Infrastructure portfolio during the first half of 2024, reinforcing the bank’s strategic focus and resilience in a competitive financing landscape. Driven by the ongoing growth of this Digital Infrastructure sector, NIBC successfully grew its Infrastructure portfolio by 1%, reaching EUR 1,912 million as of June 2024.

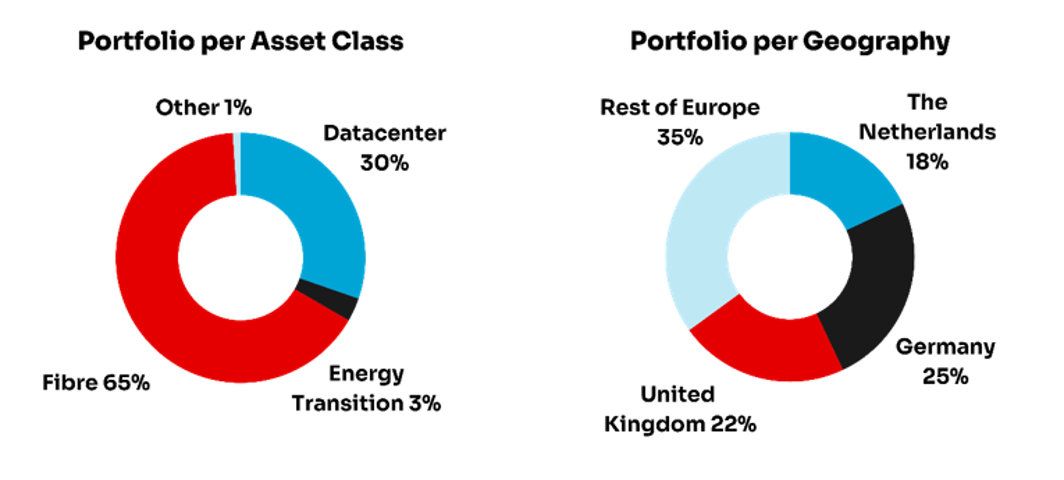

The Digital Infrastructure division remains a key pillar of NIBC’s Asset-Based Finance segment. The bank has effectively navigated the competitive market by focusing on financing essential digital infrastructure projects, including data centres and fibre networks. This targeted approach has allowed NIBC to continue expanding its portfolio, supporting the development of critical infrastructure that underpins the digital economy.

Jan Willem van Roggen, Managing Director and Head of Infrastructure at NIBC, commented on the company’s performance: “Our focus on financing data centres and other key digital infrastructure projects is a clear proof of our commitment to supporting the growth of this essential sector. The slight growth in our portfolio, despite a highly competitive market, reflects our strategic efforts to identify and back projects that will drive the future of digital storage and connectivity.”

During the first half of 2024, NIBC provided financing for a variety of digital infrastructure projects in Europe, further evidencing its position as a trusted partner for investors and developers in this rapidly evolving sector. The bank’s ability to offer flexible and innovative financing solutions has been instrumental in helping clients navigate the complexities of the digital infrastructure market.

NIBC is also actively engaging with its clients on their sustainability journeys. The bank has taken a proactive role in collecting and analysing data necessary to measure and report on the sustainability of the assets it finances. This capability not only aligns with regulatory requirements but also enables NIBC in supporting the development of sustainable digital infrastructure projects.

“Our commitment to sustainability goes beyond regulatory compliance; it’s about creating long-term value for our clients and the communities they serve,” added van Roggen. “By focusing on sustainable growth, we are playing an important role in shaping a more resilient and inclusive digital infrastructure sector.”

Looking forward, NIBC remains dedicated to support its digital infrastructure clients with tailored financing solutions that align with their strategic objectives. The bank’s expertise in digital infrastructure financing, combined with its entrepreneurial approach, positions it well to continue driving growth and innovation in a challenging market.

We refer to our Interim Report 2024 NIBC Holding N.V. published on our website for full details.