What we enable

We enable real estate ambitions for entrepreneurs and investors by providing tailor-made financing for the development and construction of real estate projects.

We finance the acquisition of real estate portfolios to facilitate investment in real estate.

Experience since 1945

Ticket Size €10m up to €50m

We offer transparent customized financing for commercial and residential real estate projects with a financing requirement ranging from €10 million to €50 million per transaction. Already financing commercial real estate with NIBC? Then we offer extended financing options starting from €5 million.

Geography

An entrepreneurial bank for entrepreneurs

Commercial real estate we finance

We offer financing for a variety of projects, ranging from commercial real estate

to residential real estate.

Tailored finance solutions

Are you looking for commercial real estate financing for your real estate project? We offer various tailored options to suit your needs.

-

Are you looking for financing for the acquisition or refinancing of existing real estate?

We offer Acquisition & Investment Financing for commercial real estate projects in the Netherlands, with financing needs ranging from €10 million to €50 million per project.

For the Benelux, DACH, Ireland, Nordics, Southern Europe and the United Kingdom we can provide investment financing between €/£15 to €/£30 million as a part of a lending club for completed residential assets that are either in let-up phase or fully stabilized.

We would be pleased to discuss your specific opportunity and provide a customized financing solution.

-

We understand that smooth financing is crucial when buying or selling property, and therefore, we offer tailor-made solutions that meet your specific financing needs.

At NIBC, you can access bridge financing for commercial real estate projects in the Netherlands.

Contact us to discuss the possibilities of bridge financing for your real estate project.

-

Are you looking for construction financing to fund the construction phase of your real estate project or for a major renovation of existing properties?

We provide construction financing for commercial real estate projects in the Netherlands with financing needs ranging from €10 million to €50 million.

For the Benelux, DACH, Ireland, Nordics, Southern Europe and the United Kingdom we can provide construction financing between €/£15m and €/£50 million as a part of a lending club for residential real estate, such as:

- Build to Rent

- Purpose-built student accommodation

- Senior housing

- Co-living spaces

Feel free to reach out to us to discuss the construction financing options available for your specific project.

-

If you are seeking financing to fund the acquisition of land (with or without the zoning in place) and / or the development of new residential real estate, including the construction (with or without the permit in place) or renovation of buildings, you can secure development financing with us.

We can offer development financing for commercial real estate projects in the Netherlands with a ticket size between €10m up to €50m.

For the Benelux, DACH, Ireland, Nordics, Southern Europe and the United Kingdom we can provide development financing for residential real estate between €/£15 million and €/£50 million. Within this sector, we can finance the following types of real estate projects:

• Build to Rent housing (BTR)

• Purpose Built Student Accommodation (PBSA)

• Senior Living

• Co-LivingDevelopment financing is typically provided earlier in the development process compared to construction financing and can be utilized for land acquisition and covering other initial costs such as design and engineering expenses.

If you have already purchased the land and have approved development plans (including permits and zoning plans), you can opt for construction financing.

-

Do you have plans to improve your properties energy efficiency?

To be eligible for an Sustainability-Linked Loan (SLL) you need to have measurable and realistic sustainability goals, as a company or for your property to be financed.

Sustainability-Linked Loans have conditions tied to our clients overall sustainability performance and/or to the property to be financed, measured by Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs).

With a Sustainability-Linked Loan, the loan margin (interest rate) is adjusted based on our clients performance or the property’s performance against specific ESG KPIs (Environmental, Social, and Governance Key Performance Indicators).

The aim? To incentivise our clients to achieve their sustainability goals, such as improving energy efficiency or upgrading energy labels.

Read more here.

Contact us to discuss your financing options

Are you looking for commercial real estate financing between €10 - €50 million for your real estate project?

Get in touch with us and discover how we can assist you in achieving your real estate ambitions.

Our expertise & experience

Since 1945, we have been supporting entrepreneurs in realizing their ambitions.

We achieve this by leveraging our expertise and experience in providing industry

specific asset-based lending that caters to the needs of our clients.

View a selection of our transactions, client quotes and video's.

Client quotes

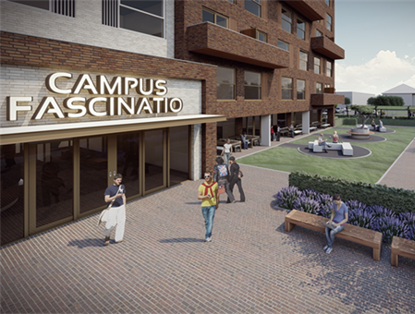

Our client cases

See how we help our clients bring their real estate ambitions to life.

View our client stories and discover why our clients chose NIBC as their finance partner.

Curious what we can do for your project? Get in touch!

Why NIBC?

-

We provide tailored bridge financing, construction financing, development financing, and investment financing to meet your specific funding needs.

In addition, we offer flexibility and fast access to liquidity, which can be essential in the highly competitive commercial real estate market.

-

As an experienced real estate financier, we possess excellent knowledge of the local real estate market.

Our dedicated real estate team ensures clear, transparent communication and a familiar presence throughout the entire duration of the facility.

-

We have been providing real estate financing since our establishment in 1945.

-

We are renowned for our quick decision-making process.

We have the ability to efficiently document and close a financing deal, enabling you to swiftly conclude your transaction.

-

We offer flexibility in our financing solutions and tailor them to meet your specific needs.

-

We are a reliable and transparent financial partner who shares the entrepreneurial spirit our clients have.

Feel free to ask our clients about their experiences with us or watch our client videos to learn more.

Our news & blogs

Always up to date with our latest news?

Subscribe for our quarterly business update and follow us on LinkedIn!

Frequently Asked Questions

-

NIBC Commercial Real Estate finances multiple asset classes such as residential real estate, retail, logistics, office, hotel, parking garage and light-industrial assets with a ticket size between €10m and €50m.

With our label ‘Vastgoedhypotheek’ we finance residential real estate with smaller ticket sizes up to €15m.

-

The amount of commercial real estate financing you can apply for will depend on a variety of factors, including the value and cash flow of the property, creditworthiness, and the type of loan you are seeking.

We finance real estate transaction between €10m and €50m and up to 75% of the property's value, depending on the property type, location, and other factors.

-

In the Netherlands, we finance real estate projects and assets for all asset classes.

Within the Benelux, DACH, Ireland, Nordics, Southern Europe and the United Kingdom we offer development and construction financing with a ticket size between €/£15m up to €/£50m for residential real estate, such as:

- Build to rent housing (BTR)

- Purpose built student housing (PBSA)

- Senior Living

- Co-Living

-

Interest rates range from 3.5% to 6%, depending on risk profile of the transaction.

-

The time it takes to get credit approved for a commercial real estate financing can vary depending on several factors, including the complexity of the transaction and the completeness of the borrower's documentation.

Overal credit approval can be done within 6-8 weeks.

Closing the transaction (after obtaining credit approval) and receiving the funds takes place within 4-6 weeks.

General timeline for our commercial real estate financing approval process:

- Pre-qualification / KYC: This initial step involves providing basic information about the borrower and the property, that evaluates whether the borrower meets the basic eligibility requirements. This step can be completed within a few days to a week.

- Loan Application: Once the borrower has completed the pre-qualification process, they can submit a loan application, which includes detailed information about the sponsor, the borrower, the property, and the proposed loan terms. The application may require a few weeks to complete, depending on the complexity of the transaction.

- Due Diligence: After the loan application is submitted, we will start the due diligence process, which involves a thorough review of the borrower's financial history, the property's financials, and the proposed loan terms. This step can take a few weeks, depending on complexity of the transaction.

- Closing: After the loan is approved, we will finalize the loan documents and close the loan. This step can take a few weeks to complete, depending on the complexity of the transaction.

-

Several factors can impact your eligibility for a commercial real estate loan. Here are some of the main factors that we typically consider:

- Property value and cash flow: we will evaluate the value of the property, the income it generates, and its potential for future income and assess the risk of the loan.

- Borrower's creditworthiness: we will evaluate your credit history and credit score to assess your ability to repay the loan.

- Debt Service Coverage Ratio (DSCR): This ratio measures the property's ability to generate enough cash flow to cover the loan's debt service (principal and interest payments).

- Experience: we consider the sponsor’s experience in managing similar types of commercial real estate properties. Having experience in managing similar properties demonstrates your ability to manage the property effectively and speed up loan approval.

- Business Plan: We may require a business plan that outlines the company's operations, financial projections, and management team. A well-developed business plan can increase your chances of loan approval.

Ultimately, your eligibility for a commercial real estate loan will depend on a combination of these factors, as well as other factors that may be specific to your situation.

-

Collateral requirements for commercial real estate financing can vary depending on the the size and type of the property, and the borrower's financial situation. However, the most common types of collateral for commercial real estate financing include:

- The property itself: In most cases, the commercial property being purchased or refinanced serves as the primary collateral for the loan. We will analyse the property's value, location, condition, and cash flow to assess the risk of the loan.

- Sponsor Guarantee: We may require a sponsor or a holding company guarantee which agrees to take responsibility for (a portion of) the loan in case of default. This guarantee may be secured or unsecured.

- Other Assets: We may also consider other assets of the borrower as collateral. These assets can include equipment, inventory, accounts receivable, or other business-related assets."